Living in South Florida means enjoying sunny days, beautiful beaches, and warm weather year-round. But it also means one harsh reality: hurricane season isn’t a maybe—it’s a guarantee.

And here’s where many homeowners get caught off guard:

Hurricane insurance doesn’t cover flood damage. And flood insurance doesn’t cover hurricane wind.

If you only have one of the two, you're gambling with your financial future.

Let’s break it down.

It’s late September. Hurricane Elena slams into Broward County as a Category 3 storm. Winds clocked at 115 mph. Your Fort Lauderdale home takes a direct hit.

- Wind tears off part of your roof.

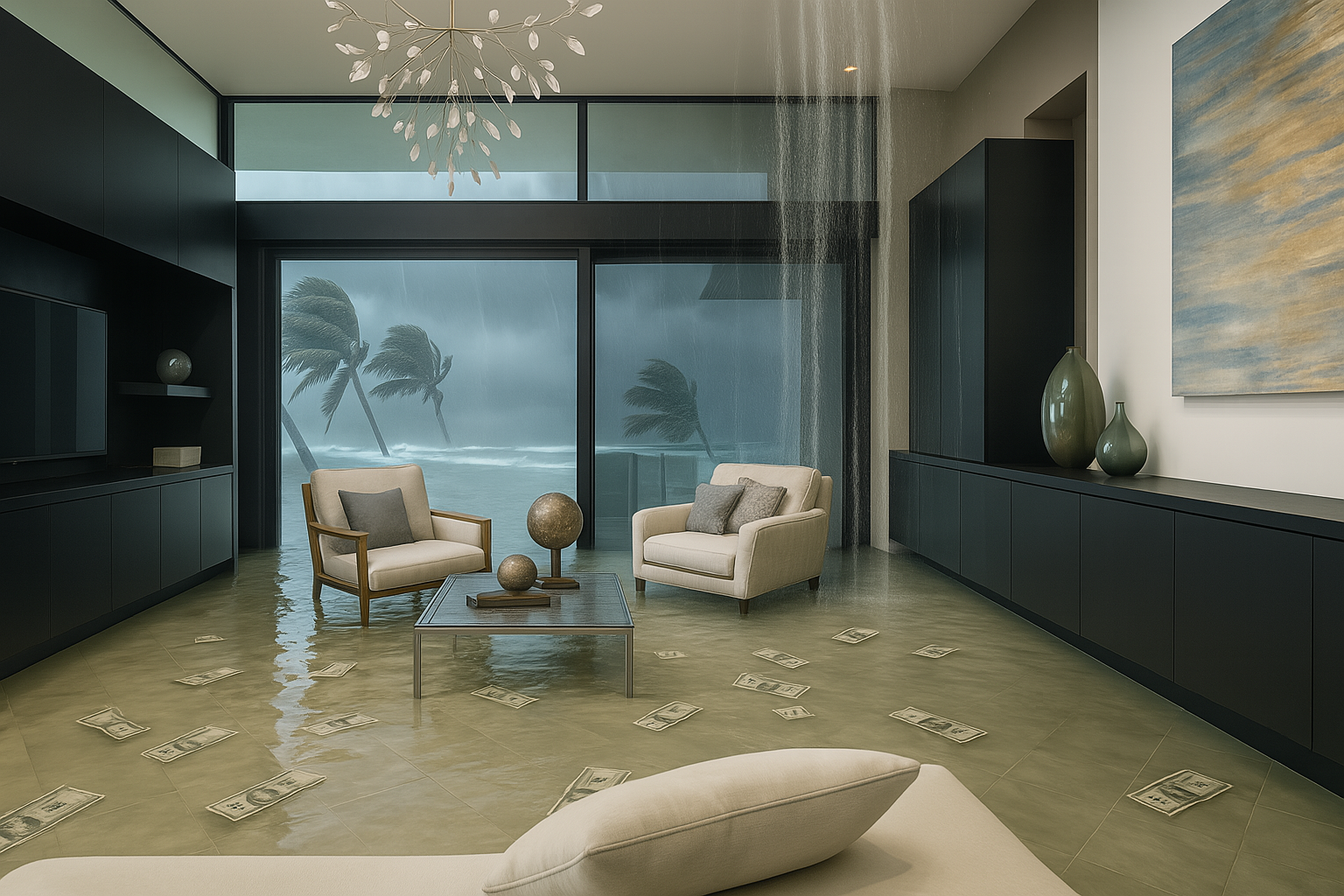

- Rain pours into your living room.

- A massive oak tree crashes into your screened patio.

- Then comes the storm surge—three feet of water flood your entire first floor. Cabinets, furniture, and electrical systems are ruined.

Here’s how coverage plays out:

- Your windstorm insurance covers the damage caused by wind: the torn roof, rain that entered through openings, and structural impacts like the broken fence or patio enclosure.

- Your flood insurance covers the water that rose from the ground and filled your home.

But here’s the catch: even though the flood was caused by a hurricane, your hurricane or windstorm insurance does not cover flood damage. Rising water—from storm surge, overflowing canals, or heavy rainfall—is only covered by a separate flood policy.

If you only had one policy, you’d be stuck paying tens of thousands out of pocket for the other half.

What Does Flood Insurance Cover?

Flood insurance protects against damage caused by rising water from outside your home—whether from storm surge, heavy rains, or overflowing bodies of water. It doesn’t matter if the water came fast or slow—if it entered at ground level and pooled inside, it’s flood damage.

Typically covered:

Flooring, drywall, and ceilings damaged by rising water

Electrical and plumbing systems

Major appliances (water heaters, HVAC, refrigerators)

Foundation damage

Debris removal

Not covered:

Wind-driven rain or plumbing leaks—that’s for homeowners or windstorm coverage.

What Does Windstorm or Hurricane Insurance Cover?

Windstorm insurance protects against direct wind damage from hurricanes, tropical storms, or even high-wind thunderstorms. In South Florida, it’s often a separate policy or rider added to your homeowners insurance.

Typically covered:

Roof damage or loss

Shattered windows, damaged doors or siding

Interior water damage caused by wind-driven rain

Damage to fences, screened patios, sheds, or carports

Cleanup from windblown debris and fallen trees

Not covered:

Flooding or water rising from the ground up.

Why Timing Matters

Once a storm gets named, most insurance companies put a temporary freeze on issuing new windstorm policies. Flood insurance often comes with a 30-day waiting period before it activates.

So if you’re scrambling to call your agent as a storm nears, you’re probably too late.

The most active months—August and September—are here. This is your reminder to review your coverage now and make changes before the next weather system forms off the coast.