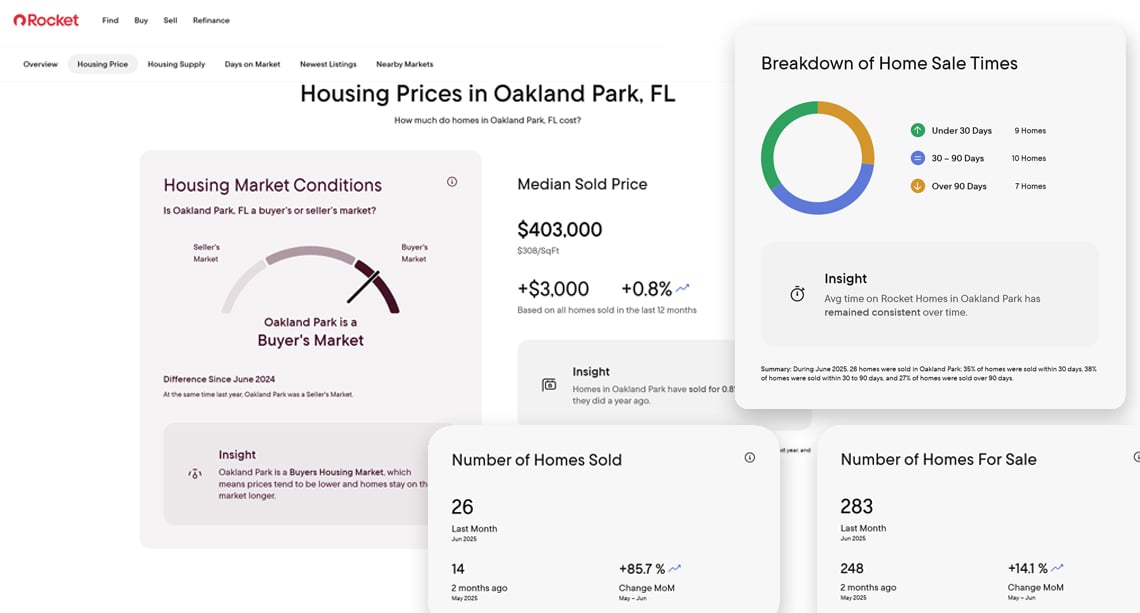

According to RocketMortgage’s public housing report, 26 homes sold in Oakland Park in June 2025, with a median sale price of $403,000 and a median price per square foot of $308. For the average homebuyer—or even a casual investor—those figures feel reliable. The report is clean. The chart is crisp. The message: the market is calm, maybe even cooling.

But it’s not. It’s the rough outline of a house with no foundation.

And this isn’t just a data problem—it’s a consumer protection issue.

Misinformation, even unintentional, shapes perception. And perception shapes pricing, negotiation power, and long-term investment confidence.

If you’re buying, selling, or even just watching the market, don’t rely on a filtered feed to tell you the full story. Demand better data. Demand local insight. Demand the truth.

Pull up the actual market data from BeachesMLS—the same system real estate agents, brokers, and appraisers use every day—and you get a different picture entirely:

62 total residential properties sold in Oakland Park in June

36 were single-family homes, with a median sale price of $492,500

26 were condos and townhomes, with a median of $202,450

Rocket’s $403,000 “median” doesn’t align with any one property type. It’s a hybrid number—drawn from a limited sample of mixed listings—and worse, it accounts for less than half of the actual closings that occurred.

And that’s where the problem begins.

WHAT'S CAUSING THE DISCREPANCY?

Platforms like RocketMortgage, Redfin, and even Zillow pull their figures from limited MLS feeds, third-party aggregators, and delayed or incomplete reporting. Many listings are missing entirely—especially those from brokers who opt out of syndication. What’s worse, these platforms don’t always separate by property type, which matters a lot in cities like Oakland Park, where a 1-bedroom condo and a 4-bedroom pool home can sell in the same week but exist in totally different markets.

When these fundamentally different property types get lumped together into a single number, the result is technically true—but practically useless. It’s like averaging the price of a Vespa and a Chevy Tahoe, then calling it “the cost of transportation.”

WHAT THE MLS DATA REALLY SHOWS

BeachesMLS, the source professionals use daily, paints a much more accurate picture:

In June 2025, 62 total residential properties closed in Oakland Park

36 single-family homes had a median sale price of $492,500

26 condos and townhomes had a median price of $202,450

That’s more than double the number of closings RocketMortgage reported—and with far more useful price distinctions. The public-facing platforms stripped out context. BeachesMLS delivers it.

FINAL THOUGHT

This isn’t just about stats. It’s about how people make decisions—where they move, what they offer, how they negotiate. Bad data warps reality. Whether it’s through omission or oversimplification, national platforms are not built to reflect local truth.

That’s why working with a local expert who actually understands this market—and has access to real numbers—isn’t optional. It’s critical.