FICO to Factor BNPL into Credit Scores, Sparking Concern for Millions of Americans

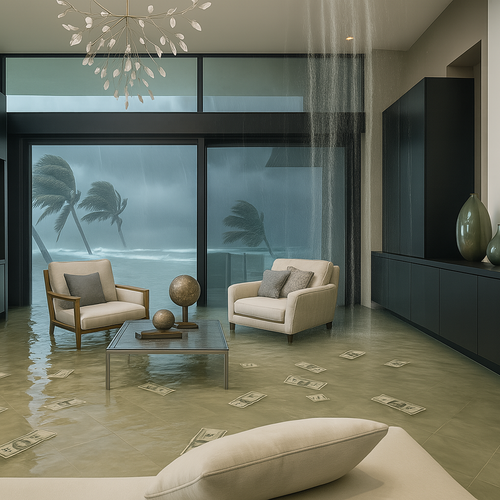

You didn’t think twice. You split your Best Buy laptop into four payments with Affirm. Used Klarna to grab $200 worth of back-to-school supplies at Target. Booked a weekend on Airbnb. Grabbed a few things from Ulta. Ordered dinner on Uber Eats—BNPL again.

It all felt manageable… until now.

This fall, FICO—the company behind the credit score used by 90% of lenders—will start factoring those “Buy Now, Pay Later” (BNPL) purchases into its newest scoring model, FICO 10T.

That means everything from your Apple Watch to your groceries could quietly start reshaping how lenders see you.

And here’s the real kicker:

It doesn’t matter if you’ve never missed a payment

It doesn’t matter if the items were paid off in four weeks

It doesn’t matter if the payments were “interest-free”

You could still be flagged as high risk—just for using BNPL too often.

If you’re juggling multiple BNPL accounts, it’s now a credit red flag.

If you miss just one payment, even by a few days? That can flip your 0% promo rate into a high-interest penalty, hit your credit report, and quietly drag down your score.

That means you could face higher mortgage rates, car loan rejections, credit card denials, or worse—no approval at all when it matters most.

What Is BNPL and Where Are You Using It?

BNPL, or Buy Now, Pay Later, lets you divide purchases into smaller, usually interest-free payments over a few weeks or months. Originally designed to help consumers manage larger purchases without interest, it’s now a staple of everyday checkout screens.

The problem is just how easy—and how invisible—it’s become.

Major retailers offering BNPL include:

Amazon (via Affirm)

Target (Sezzle, Affirm)

Walmart (Affirm, Klarna)

Apple, Nike, Adidas, Sephora, Ulta, Best Buy, and Bed Bath & Beyond

Even Uber Eats, Instacart, and Airbnb offer BNPL at checkout

That means you might be financing shampoo, sneakers, lunch, groceries, or your next vacation—and soon, those loans will be part of your credit history.

What’s Changing with Credit Reporting?

Credit bureaus—Equifax, Experian, and TransUnion—have already started collecting BNPL data. Some platforms are already participating, and more are expected to follow:

Affirm reports to Experian and is expanding to other bureaus

Klarna and Afterpay are reporting missed payments (but not yet full histories)

Sezzle is rolling out optional credit reporting features

PayPal’s Pay in 4 doesn’t currently report—but that’s likely to change soon

With FICO 10T incorporating this data, your credit score may soon reflect your BNPL behavior—on top of credit cards, loans, and existing debts.

Why It Matters to You

Let’s be blunt. With inflation rising and incomes lagging, BNPL has become a lifeline for many households. But as John Zajac of the Better Business Bureau warns,

“People don’t realize they’re borrowing against money they haven’t earned yet.”

That’s the problem. You’re not just managing payments—you’re creating invisible debt.

And the data proves it:

Over 20% of Americans have used BNPL (CFPB)

Nearly 25% of them paid late in 2024—up sharply from the year before (Federal Reserve)

Even if you’re on time, having too many BNPL accounts can make lenders nervous. It signals potential financial overextension—even if the individual loans are small.

Just one mistake—a missed $30 installment to Klarna or a delayed Affirm payment—could drop your score, increase your interest rate, or disqualify you entirely.

What You Can Do Now

Check if your BNPL provider reports to the credit bureaus. If they do, your payment history matters.

Avoid using BNPL for essentials like groceries, gas, or takeout. If you're financing daily expenses, reassess your financial habits.

Limit the number of active BNPL accounts at any given time. Too many accounts, even with small balances, can make you look overextended.

Set up autopay or calendar reminders for every installment—especially if you juggle multiple providers.

Monitor your credit regularly at AnnualCreditReport.com, which provides free weekly reports from all three bureaus.

Final Word

This isn’t anti-BNPL—it’s pro-awareness.

Used wisely, BNPL can be a helpful budgeting tool. But if you treat it like invisible money or rack up plans without thinking, it becomes a trap.

A convenience spiral that quietly chips away at your credit standing.

BNPL has changed the way America shops. Now, it’s changing how lenders judge you.

You wouldn’t ignore a credit card balance.

Don’t ignore this either.