Florida Realtors economist: Active inventory is up 68% year-to-year, but largely at higher price points as listings in the $150-$300K range continue to contract.

ORLANDO, Fla – Strong demand from local and out-of-state buyers fueled by cheap mortgages the last few years pushed overall active inventory to historic lows. Strong demand plus limited inventory created an environment for intense competition and increased sales prices.

The situation was becoming untenable as more and more people were being pushed out of the market by high prices and high risk. The Fed also threw water on the fire by increasing the Federal Funds Rate, which in turn elevated mortgage interest rates.

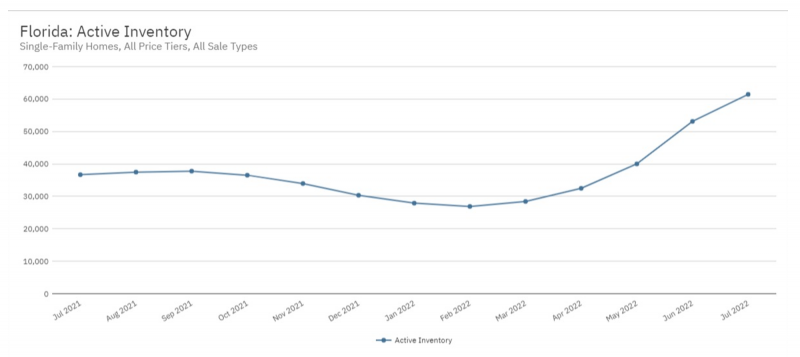

Fast forward to today, and the market is finally seeing more homes go up for sale, which should provide relief to buyers who, until recently, have had little to choose from. As of July 2022, active inventory across the state of Florida increased nearly 68% year over year. Current homeowners looking to cash out on record high prices are incentivized to take their chances in the marketplace.

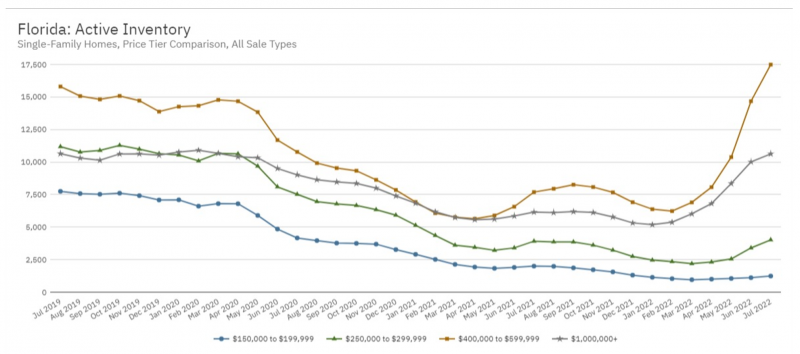

However, there is more to be told when you consider different price points. Simply put: Not all price tiers are behaving the same way. Inventory for the lower end of the market, $150-$300,000, continues to contract, particularly compared to pre-pandemic years. Three years ago, back when “corona” was still associated with a lime, Florida inventory for properties in this price point was between 7,000-11,000 homes on the market in a given month. Today, there are less than 1,500 homes prices between $150,000-$200,000 – and only slightly more under $300,000.

There are a myriad of reasons for this. First, investors have long targeted the lower price points in their hunt for a low basis that provides healthy returns. And for some first-time homebuyers, pandemic-era changes helped them come up with a down payment and buy a home, including government stimulus checks issued during the early days of the pandemic, and record-low mortgage rates that stretched buyer dollars further.

If we think about the game “Musical Chairs,” the music started in mid-2020 and a lot of people were able to get chairs. But as more people entered the game, there weren’t enough chairs. Now the music is slowing down and the people who secured a spot early in the game are reluctant to give up their chair. As a result, fewer of these lower-priced homes are going back on the market and, when they do, they are often in a much higher price point.

In fact, much of the story behind dwindling inventory in lower price points is a function of maturing pricing; that is, the prices for homes overall have increased so what would have been a $150,000 home in 2019 is now in the $250,000 tier. It’s the rising-tide-lifts-all-boats concept at work.

An interesting story is also playing out at the top end of the market. Typically, in times of economic uncertainty, money floods to quality as a means of creating security. Inventory of higher-priced homes certainly toppled quickly in the early days of the pandemic, as would be expected. However, in recent months, active inventory has risen most sharply among the $400,000-plus homes and even the $1 million homes.

Whether this is due to long-time owners listing homes at seemingly aspirational prices to cash out in this crazy market or some version of buyers’ remorse, it’s hard to tell by looking at the data alone. But the trend is notable as we continue to move through the recovery phase of this economic cycle. Demand is also somewhat challenged as increasing lending rates limit purchasing power, making the stretch to a higher price point less likely.

Consider the price tier you typically work in and take a dive into the stats in your local area using SunStats. You may find that inventory in your area may be different depending on price and property type. Being able to discuss these differences with your clients will certainly help them better navigate this ever changing marketplace.

Jennifer Warner is an economist and Florida Realtors Director of Economic Development

By Jennifer Warner | © 2022 Florida Realtors®

Read the Original Article Here: More Fla. Inventory? Depends on Price Tier